All of us who lead a business or want to lead a business encounter so many opportunities. There is no shortage of business opportunities out there. And opportunities to launch a new product or service in our existing business. In the USA businesses are formed (and closed) every day…thousands of them.

So how can we tell whether we should go into a business or, if we are already leading a business, invest in developing (or buying) a new product or service? So many of my EMyth business clients just jump into a new product or service without taking the time to really analyze whether the business or product/service makes sense. Through coaching, I help them become much more systematic and strategic…and smart…about making this kind of decision.

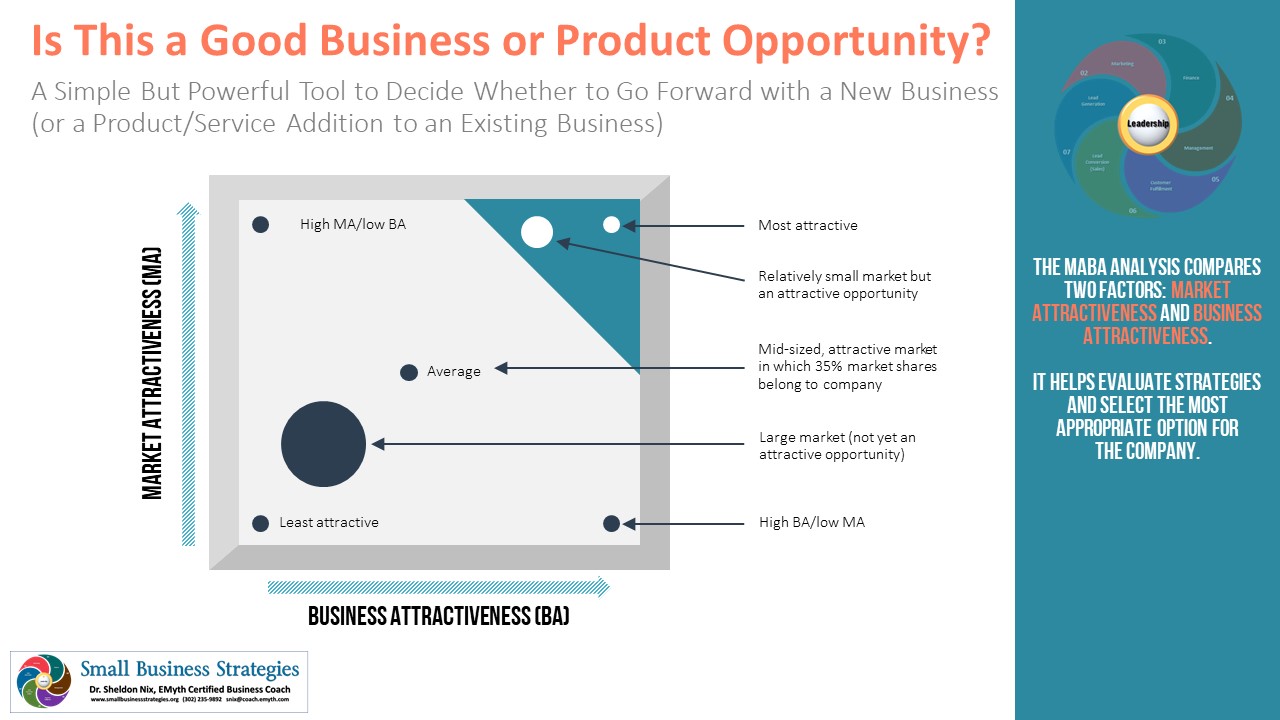

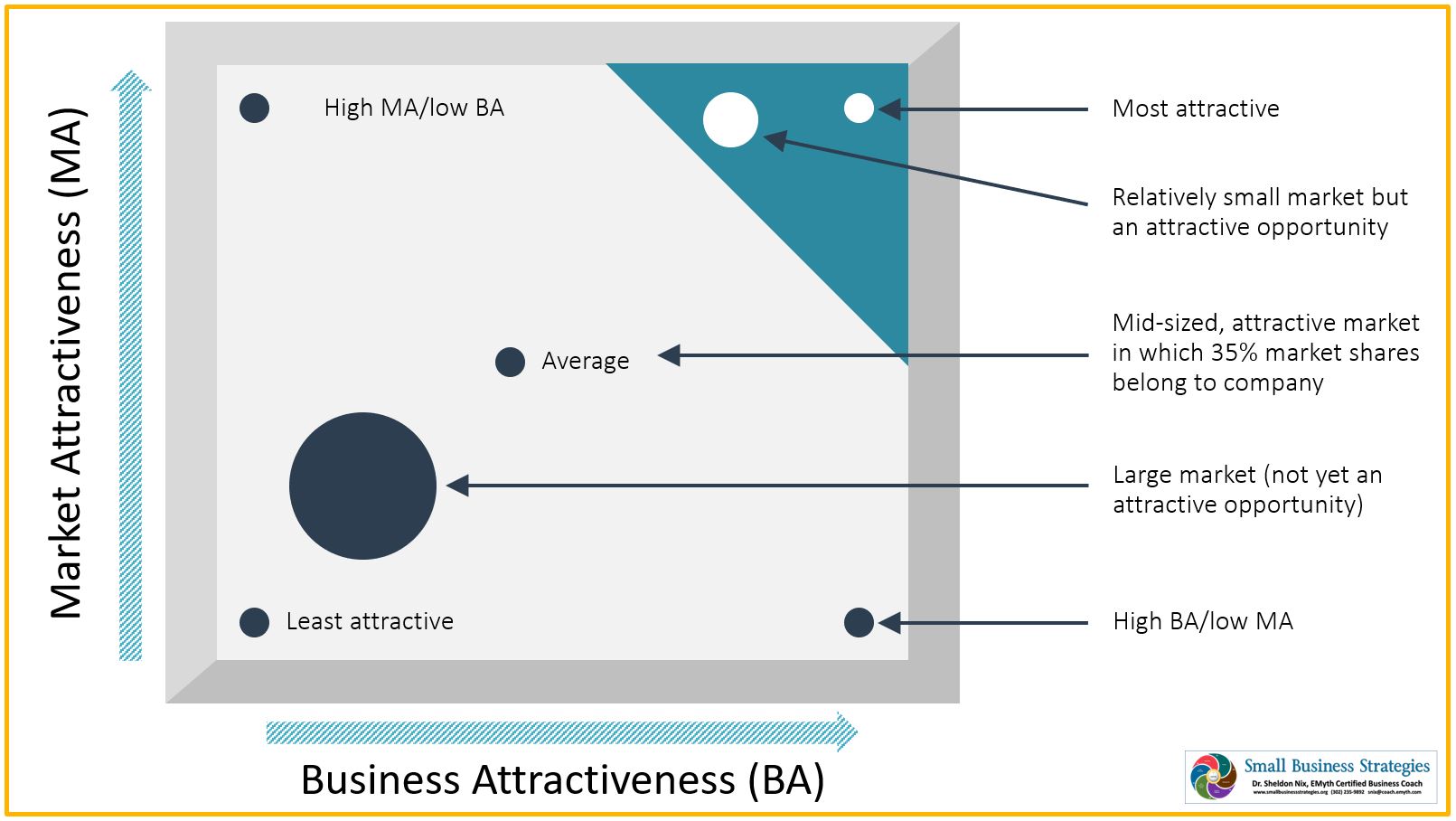

At EMyth we use what we call the Product/Market Grid to help them in this analysis, as well as some other tools. But the “MABA Analysis” is a similar tool for you to use to make a good decision on this question. (It is a part of the Boston Consulting Group matrix portfolio analysis).

Let's Talk Strategy

There are two areas to look in: The attractiveness of the Market and the attractiveness of the Business (or product/service).

How Attractive is This MARKET?

I once read a quote: “The key to a successful restaurant is a hungry market.” While that, of course, is overstated, it contains a key strategic idea: The dynamics of the market are important. In the MABA Analysis, you study the market to see how attractive it is. You might use factors such as:

- How big is the market? (Enough potential customers to support your business costs and revenue and profit goals.)

- How accessible is this market to us? (The customers might be out there, but if you don’t have a good way to reach them, then this might not be a very attractive market for you.)

- What is the competitive landscape? (It might be a big, accessible market, but if there are powerful players already grabbing up most of the customers, you will have a fight on your hands.)

- What is the maturity level of the market? (Will you have to educate them on the product/service you intend to introduce, meaning it’s in the early stage? Is it a mature market which has seen so many of these products that they have become almost a commodity, common. Products have life cycles, but I think markets do also.)

- What are the financial resources this market has with which to buy your product/services? (A big, accessible market with no competitors…but with little money…might mean you won’t generate enough revenue unless you are able to be so efficient in your operations that you can charge low prices, and/or you are able to get a lot of customers.)

You can add your own relevant market factors to this list.

How Attractive is This BUSINESS (or PRODUCT)?

Next comes an analysis of the business or product itself. How strong is this business or business unit? How you measure strength is not something I can generalize on, but it might include things like:

- Are core competencies used for this new opportunity or would it involve a wholesale learning of new skills and knowledge?

- Do you have the talent to staff this new opportunity or is such talent readily available? If not, then that’s a red flag.

- Do you have the financial resources it will take to launch this business or product and sustain it until it gets traction? (Even if you use a Lean approach to starting up, you will still need capital, especially after traction when you start to scale.)

- Do you have the passion for this? Does it fit your Vision, Mission, Values, etc.? Without that fire in the belly, including the organization’s belly, it is probably not a good fit.

Now Decide How Attractive Is This Business or Product Opportunity

Now, you take the answers to these two sets of questions and put them on a grid or in a 9-cell matrix. In our EMyth coaching, our Product-Market Grid uses as many cells as necessary to help clients compare markets and products so they can identify the best Product-Market combination as well as the next best, etc.. But just to illustrate the essence of this, look at the following results:

Clearly there is a sweet spot where both the Market and the Business are attractive (upper right corner). If your business or product opportunity is in that region, then you can Invest in it.

In the middle region are the Average opportunities. Average Market attractiveness and average Business or Product- attractiveness. These might be worth investing in. If you are already running such a business or product, then you would maintain it and seek to grow it.

At the bottom left are the “opportunities” that are low in both Market and Business/Product attractiveness. These are decidedly not the “opportunities” you would invest time or money in!

So there you have it…a simple concept for deciding whether to invest in a business or product opportunity.

You Don’t Need to Figure It Out All Alone

Recent Comments